The Vaca Muerta unconventional deposits drove a sharp rise in hydrocarbons output in the first part of this year

Hydrocarbon production reached a 20-year high in the first seven months of 2024, driven by output at the Vaca Muerta unconventional fields. The increase helped to reverse the energy sector’s continuing trade deficit since 2011. Although developing the oil and gas industry has been a policy priority for recent governments and administrations, President Javier Milei’s liberalisation policies may increase the sector’s attractiveness.

What next

Subsidiary Impacts

- Growing output could help boost exports, foreign reserves, and national and provincial tax revenues.

- Oil pipeline projects aim to increase exports, while gas pipelines will allow domestic output to replace imports.

- Argentina’s history of policy shifts remains likely to discourage long-term investments.

Analysis

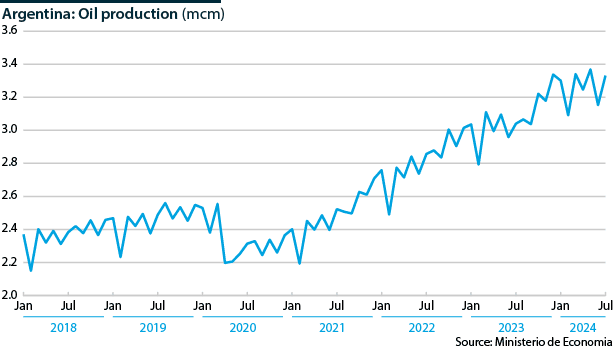

In the first seven months of 2024 oil production reached 22.8 million cubic metres (mcm), up 8.6% year-on-year, and the highest level since 2005. However, it remains far below the 49.1 mcm reached in 1998. Natural gas production also reached a peak of 29.8 billion cubic metres (bcm), the highest since 2006, and up by 6% year-on-year. The highest-ever production was 52.1 bcm in 2004.

Production recovers

Except for 2020, during the COVID-19 pandemic, there has been an energy trade deficit every year since 2011, driven by high domestic demand (boosted by subsidised tariffs) and government intervention, which discouraged new investments.

However, the gradual unfreezing of tariffs, a more favourable regulatory framework, and the boom of oil and gas production and investment in Vaca Muerta helped to reverse this deficit (see ARGENTINA: Oil and gas optimism still faces obstacles – November 18, 2022). In the first half of 2024 the energy trade surplus reached USD2.1bn, with exports up by 29% and imports down by 56.8%.

Oil exports reached 168,000 barrels per day (b/d) in the first half, the highest level for two decades. Export volumes rose by 46% year-on-year and by 157% over the average of the last decade. Oil export earnings were up 60.2% to USD2.5bn, boosted by a 21% increase in average export prices compared with the last 20 years. Export volumes remain far from the 1998 peak of 336,000 b/d.

At the same time, natural gas imports fell by 15.3% in the first half, with liquefied natural gas (LNG) imports falling by 74%, largely due to the 2023 inauguration of the Nestor Kirchner pipeline connecting Vaca Muerta with Argentina’s central region.

RIGI

In August, the government issued the rules for its Incentives for Large Investments Regime (RIGI) (see ARGENTINA: Policies raise more questions than answers – July 15, 2024). Companies will have two years to adhere, though this may be extended for one additional year. Minimum investment amounts include:

- USD600mn for offshore oil and gas projects and gas production for export;

- USD300mn for oil and gas transport and storage; and

- USD200mn for processing, refining and fertiliser production.

Onshore oil upstream activities were excluded, as current incentives are considered sufficient to promote development.

~36.6bn

Hydrocarbon investments expected by 2030

The government expects important hydrocarbon investments in the second half of the decade:

- Oil investments in upstream activity (including Vaca Muerta and conventional fields) and refining are expected to reach around USD11bn in 2027-30.

- Investments in new gas pipelines are expected to total about USD16bn in 2026-27, with unconventional gas investments reaching some USD5bn.

- Investment in expanding pipeline capacity is expected to reach USD4.6bn.

The most important projects underway aim to overcome bottlenecks in transport infrastructure, which are hindering production growth.

Petronas problems

However, the government suffered a blow following rumours that Malaysian Petronas will withdraw from a USD30bn project to build an LNG plant with Argentine oil company YPF to export gas from Vaca Muerta.

The plant was originally to be built in Bahia Blanca, Buenos Aires province, governed by Kirchnerist Axel Kicillof. In July YPF announced the plant would be built in Rio Negro province, possibly because Kicillof refused to join RIGI. However, Rio Negro port infrastructure required substantially more investment than Bahia Blanca, prompting rumours that Petronas would withdraw. Although YPF says it will seek a new partner in that event, Petronas’s withdrawal would put the project on hold.

Infrastructure works

Several projects seek to increase oil transport capacity and exports.

The DUPLICAR project aims to increase the daily transport capacity of the 525-kilometre pipeline linking Vaca Muerta with Bahia Blanca. In August, the OLDEVAL consortium leading the project announced that oil exports could more than double to 310,000 b/d by year-end.

The Vaca Muerta Sur oil pipeline will connect unconventional fields in Neuquen province with Punta Colorada (Rio Negro). In May, YPF started the first section, which will connect Vaca Muerta with Allen (Rio Negro), and in June it launched an international bid to build the 440-kilometre pipeline connecting Allen with Punta Colorada. The new pipeline is expected to start carrying 180,000 b/d in the second half of 2026, rising to 700,000 b/d in 2028. By 2030, oil exports are expected to reach 135 million barrels per year, with Asia as a potential destination. The USD2.5bn investment project is expected to be the first within the framework of RIGI.

In 2023, YPF inaugurated Vaca Muerta Norte, which connects Vaca Muerta with OTASA, the pipeline that took Argentine oil to Chile and was deactivated in 2006. Thanks to Vaca Muerta Norte, oil exports to Chile resumed in the second quarter of 2023: by July 2024, OTASA was transporting 83,000 b/d, equivalent to 75% of the pipeline’s capacity.

Expanding natural gas transport infrastructure aims to allow growing production at Vaca Muerta to substitute imports. The Northern natural gas pipeline was used to import gas from Bolivia. Reversal works costing USD700mn are expected to be completed soon, allowing it to transport Vaca Muerta gas to northern provinces.

There are also plans to increase the capacity of the Nestor Kirchner gas pipeline from 21 mcm/day to 35 mcm/day, with three new compression stations costing around USD700mn. These works are expected to be finished in 2025 when Vaca Muerta gas will replace Bolivian imports.

In the medium term, the government is contemplating a new company to raise the funds needed to increase pipeline capacity further.

Pending litigation

Investor doubts continue to focus on the durability of more business-friendly policies and on capital controls, which, on the one hand, oblige exporters to sell their foreign exchange earnings in the domestic market at the official exchange rate and, on the other hand, restrict the remittances of profits abroad.

At the same time, disputes between the government and foreign investors over the 2012 renationalisation of YPF persist.

Last year a New York judge ruled that Argentina owed USD16bn to Burford Capital, which bought the rights to litigate the case (see ARGENTINA: YPF ruling will bring new debt challenge – September 11, 2023). Burford wants the government’s 51% stake in YPF transferred to it as payment and is seeking to show that YPF is an ‘alter ego’ of the state (see ARGENTINA: YPF spending may bring new creditor demands – August 14, 2024). The US Department of Justice has asked the judge to postpone a ruling until November 6.