Regional ties with Washington have faced new uncertainties and pressures since Donald Trump’s return to the White House

Since President Donald Trump’s return to the White House, Latin American governments have come under intense pressure from Washington on three key issues: immigration, trade and Chinese influence. Several senior US officials have deep regional experience, but internal divisions and rising protectionism promise to complicate efforts to counter Beijing’s economic foothold. Both US rivals and Trump’s ideological allies in Latin America are exposed domestically to the fallout from US tariffs and global economic volatility.

What’s next

US policy toward Latin America will be shaped by the Trump administration’s domestic agenda. Most regional leaders will avoid direct confrontation with Washington and concede to Trump’s demands but will pursue alternative partnerships. The elimination of US development assistance will create new openings for Chinese engagement. Overall, cooperation between the United States and Latin America will remain limited due to Washington’s unpredictability and protectionist policies.

Subsidiary Impacts

- President Javier Milei could struggle to turn his ideological affinity with Trump into concrete policy benefits for Argentina.

- US tariffs and aggressive diplomacy risk triggering a nationalist backlash in multiple countries.

- Regional governments’ readiness to concede to Trump’s priorities will matter more than ideological alignment in maintaining good relations.

- US firms will hesitate on nearshoring, giving China an opening to expand its economic footprint.

Analysis

The first months of the second Trump administration have been turbulent for Latin America. Engagement has been marked by the administration’s internal divisions, tariff threats, sudden policy reversals and the dismantling of US soft power initiatives in the hemisphere. Even declared US allies are suffering from US protectionism and global instability, making it difficult to translate alignment with Washington into concrete benefits domestically.

While the administration is likely to obtain short-term concessions on its key priorities, in the longer term the United States could find it harder to promote its economic and diplomatic interests in the region.

U-turn on Venezuela

Secretary of State Marco Rubio and Special Envoy to Latin America Mauricio Claver-Carone advocate a policy of stricter sanctions and “maximum pressure” against leftist governments in Cuba, Nicaragua and Venezuela. They also favour a robust effort to displace Chinese economic and diplomatic influence in Latin America. In contrast, Richard Grenell — another top diplomatic adviser –advocates a more transactional, less ideological approach.

In late January, Grenell met with President Nicolas Maduro in Caracas, the highest-level US visit to Venezuela in decades. During the meeting Maduro agreed to accept Venezuelan deportees from the United States and to release six US detainees in Venezuela (see VENEZUELA/US: Maduro gains from warmer ties, for now – February 12, 2025).

The surprising rapprochement, however, ended only weeks later when Trump revoked the temporary licence granted to Chevron to export Venezuelan oil, accusing Maduro of failing to uphold the deportation agreement. The reversal threatens to deepen Venezuela’s economic crisis and encourage even more outward migration, although the subsequent US deportation of Venezuelans to a maximum-security prison in El Salvador may boost nationalist feeling and strengthen Maduro’s domestic position (see VENEZUELA: Oil sanctions impact will not shift Maduro – March 13, 2025).

Milei tightrope

The Argentine president has positioned himself as Trump’s closest ally in Latin America, although his free-trade stance clashes with Trump’s protectionism. Argentina will not be exempt from US “reciprocal tariffs”, set to take effect in April, and will suffer significant losses if Trump maintains his 25% tariffs on all steel and aluminium imports. Furthermore, market volatility caused by Trump’s trade policies have particularly affected Argentine bonds, jeopardising the country’s fragile recovery.

While Trump and Milei have publicly floated the idea of a bilateral free trade agreement (FTA), political and economic constraints make this unlikely. A limited deal to avoid some tariffs is more plausible. Another obstacle is that Claver-Carone has openly criticised Milei’s inner circle, particularly Cabinet Chief Guillermo Francos, whom he blames for his 2022 removal as president of the Inter-American Development Bank (IDB) when Francos was Argentina’s IDB representative under the previous, Peronist government (see LATIN AMERICA: US vote may decide IDB presidency – November 15, 2022).

Despite Claver-Carone’s criticism of Milei’s economic policies, the Trump administration is expected to back Argentina’s bid for new IMF financing.

China and immigration

Rubio’s first international trip as secretary of state took him to Panama, El Salvador, Costa Rica, Guatemala and the Dominican Republic, where he secured agreements to increase deportations from the United States, including dangerous criminals and third-country nationals.

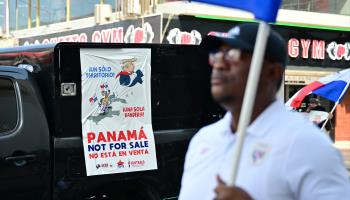

In Panama, Rubio publicly condemned Chinese investment near the canal, reinforcing the administration’s push to curb Beijing’s economic footprint in the region (see LATIN AMERICA: Chinese role will boost US tensions – January 6, 2025). Just days later, on March 5, a BlackRock-led US consortium finalised its purchase of 90% of CK Hutchison’s Panama-based port assets, including two key terminals on both sides of the canal. As a diplomatic gesture, Panama also withdrew from China’s Belt and Road Initiative, though this move carries no concrete policy consequences.

The White House framed the deal as a strategic victory, with Trump declaring that the United States was “reclaiming the canal”. However, nationalist sentiment in Panama has surged in response to US rhetoric. Future clashes are likely, particularly after Claver-Carone suggested that US infrastructure investments should come with greater operational control over the canal.

Regional institutions

The Organization of American States (OAS), traditionally the main forum for US-Latin America relations, selected a new secretary-general on March 5. Suriname’s Foreign Minister Albert Ramdin is expected to take a less confrontational stance on Venezuela, Cuba and Nicaragua than his predecessor, Luis Almagro.

Institutional and financial pressures on regional organisations may mount

Although Claver-Carone praised Ramdin and dismissed concerns about Suriname’s ties to China, there are fears that Washington may pressure the OAS to align more closely with its regional agenda, further weakening the organisation’s legitimacy. The United States, which accounts for over 70% of the OAS’s budget, has considerable financial leverage. At the same time, Claver-Carone has argued that his 2022 removal from the IDB presidency was due to his push for institutional reforms. This could signal renewed US pressure on the IDB, particularly on lending policies and governance structures.

Broader implications

Given Washington’s economic and diplomatic influence, most Latin American governments will avoid direct confrontation. Mexican President Claudia Sheinbaum has been praised for her measured response to Trump’s tariff threats, which included stepping up deportations of drug traffickers, boosting border security and delaying retaliatory tariffs to allow time for negotiations. In contrast, Colombian President Gustavo Petro publicly challenged Trump’s deportation policy, only to backtrack under the threat of heavy US retaliation.

However, Trump’s policies are limiting Washington’s ability to engage positively with Latin America. Trade integration has been replaced by rising barriers, with nearshoring — once encouraged by Washington — now being displaced by onshoring to the United States, reducing economic opportunities for the region.