An EY report prepared in collaboration with Oxford Analytica.

An EY report prepared in collaboration with Oxford Analytica.

With the advance of digital technologies changing the nature of business in many industries and enhanced public concern over the behavior and environmental impact of the private sector, companies are facing both new risks, and greater scrutiny over their operations.

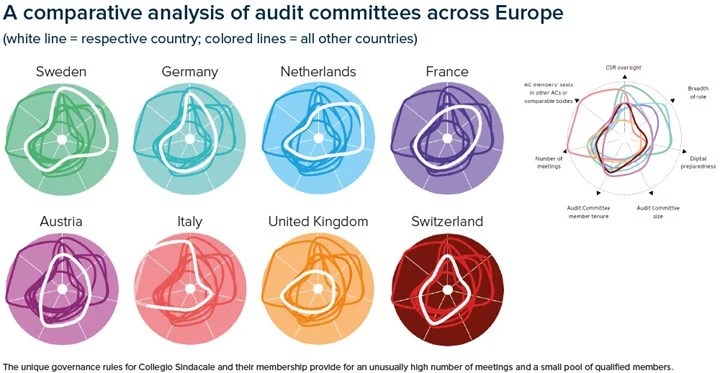

Because of these changing risk profiles, in parts of Europe today, audit committees (ACs) are undergoing a period of transition. They are transforming from backward-looking committees focused on a narrow financial remit, to more forward-looking bodies tasked with evaluating a wider set of risks. This transition, along with the different board structures among geographies, has led to a variety of outlooks and perspectives among European ACs, though many common threads remain.

Finding the effective balance between today’s operational and reporting challenges and tomorrow’s unseen risks is the greatest challenge facing European ACs today. To accomplish this task, and stay fit for purpose, European ACs should:

Establish a clear best practice for their involvement in overseeing CSR reporting and the creation of an audit (in contrast to a review) for those statements.

Acknowledge the need to add skills relevant to the digital tools, processes and systems impacting internal business functions and the role of internal and external audit.

Consider adjusting board committee tenure to help bring those new skills into the AC more quickly.

Engage more openly and formally with regulators and policy makers to help minimize any negative impacts from the increasing pace of regulatory change. By embracing the need to move into new areas of responsibility, European ACs can establish even greater trust in the financial reporting process, which is their traditional and core function.

Most importantly, they can also better prepare the firm for the future risks that will inevitably emerge.