China’s key role in the global electronics supply chain challenges Washington’s efforts to address cybersecurity threats

The Biden administration last month proposed banning Chinese and Russian hardware and software from vehicles sold in the United States, citing potential cybersecurity risks. Washington has since 2018 placed increasing restrictions on Chinese technology, intended to limit its own vulnerability and to curb China’s development. China’s share of certain US tech-good markets has fallen, but its export of inputs to the countries displacing it in the US market have risen.

What next

Subsidiary Impacts

- China’s network infrastructure projects in developing countries may create a gateway for cyberattacks launched indirectly via these nations.

- High-tech foreign firms stand to benefit from China’s strong demand for advanced capital equipment and components to boost its cyber tech.

- Chinese IT firms may advance their technology through mergers and acquisitions of foreign companies with high-tech expertise.

- Chinese semiconductor firms once recruited talent from Taiwan and may continue advancing by hiring experts from foreign firms or countries.

Analysis

As early as 2018, Washington imposed restrictions on Huawei’s business expansion in the United States due to concerns that the company could exploit network access for espionage or disrupt communications during a potential cyberwar. However, China’s significant role in the global electronic device supply chain complicates efforts to mitigate the cybersecurity threat.

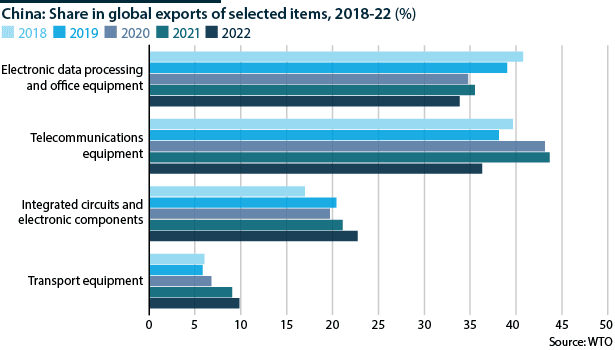

Washington’s higher tariffs on Chinese imports have prompted the relocation of final assembly operations from China to other developing countries, particularly in South-east Asia. As a result, China’s shares of global exports of computers, tablets and smartphones has fallen over the past few years.

However, the country still accounts for a significant portion of global exports of electronic devices — 36% of global exports of telecommunications equipment and 34% of electronic data processing and office equipment in 2022. For 30 years, China was the workshop of the world for electronic devices; it will take time for others to supplant it (see US/CHINA: US AI export controls on China have limits – May 29, 2024).

China has dominated global assembly of electronic devices for three decades

Meanwhile, foreign firms’ relocation of final assembly outside China has accelerated the country’s industrial upgrade, to producing and exporting key components to developing countries. This is evident in China’s expanding shares of global exports of key components such as integrated circuits (ICs), electronic components and transport equipment.

‘China threat’ through indirect exports

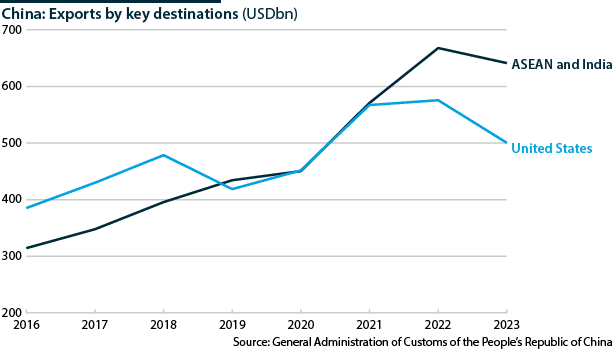

The United States may find it difficult to mitigate cybersecurity threats from China through import restrictions, as China can still export electronic devices to the US market via other countries. According to the Chinese official statistics, although Beijing’s exports to the United States were stagnant after 2021, its exports to ASEAN and India surged.

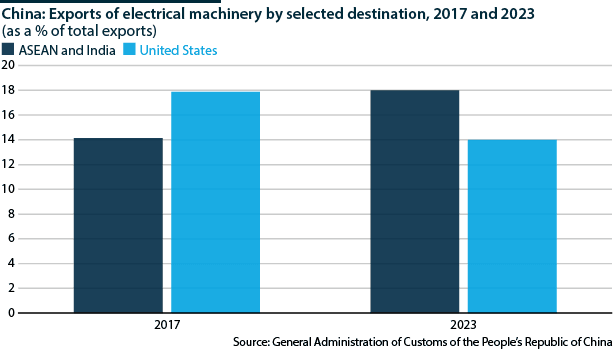

Most of these growing exports were driven by electrical machinery. The proportion of China’s electricial machinery exports to ASEAN and India expanded from 14% in 2017 to 18% in 2023. The proportion going to the United States fell during the same period.

The ICs and electronic products constitute the largest part of China’s exports of electrical machinery to ASEAN and India, whereas most of the electrical machinery going to the United States are finished or final consumption goods such as computers and smartphones.

Although the US export control measures and import restrictions on certain Chinese goods have reduced China’s share of the US market, Chinese firms have responded by becoming key component providers for the countries that to an increasing extent supply end-users in the United States (see CHINA/US: Managing tensions will remain key – July 5, 2024).

Resilient foreign direct investment

Since China joined the WTO, its trade in manufactured goods has largely been fuelled by foreign firms investing in the country, highlighting the critical role of foreign direct investment (FDI) in promoting China’s place within global supply chains.

However, since 2012, rising wages have prompted FDI to shift to developing countries in South-east Asia. More recently, escalating geopolitical tensions with the United States have further accelerated this trend of investment relocation.

As Chinese wages have risen, FDI has moved to developing countries in South-east Asia

Although FDI in ASEAN’s manufacturing has surpassed China’s since 2018, Chinese official statistics report that the FDI in China’s manufacturing sectors has remained resilient over the past decade.

Indeed, the de-risking strategy that many European countries and the United States adopt does not mean excluding China. Therefore, China is still part of the investment diversification of global businesses. For example, in July 2024, Foxconn — the world’s largest electronics manufacturer — announced new investments in China’s tech research, despite having moved part of its production capacity to India and Vietnam in recent years.

Effectiveness of US export controls

In 2020, under the Trump administration, Washington began restricting the export to China of semiconductor technology, a key to enabling cyber devices.

The Biden administration extended export control measures intending to contain China’s technology advances more effectively. All firms, including both US and foreign, are not allowed to sell China advanced chips and related semiconductor equipment.

Those restrictions do not seem to have cut China’s links with manufacturers of high-technology goods in other countries. China’s official statistics showed that its imports of semiconductor equipment and ICs continued to surge over the past few years.

Indeed, some companies, including Nvidia, were found to have continued to supply China with essential equipment and components despite the US government’s restrictions (see CHINA: Semiconductor smuggling presents new challenges – September 10, 2024).

US restrictions have not cut China’s links with high-technology manufacturers in other countries

According to the US Bureau of Economic Analysis, China in 2023 paid USD7-9bn for the use of US intellectual property, making it the largest global consumer, followed by Canada, Switzerland, the Netherlands and Ireland.

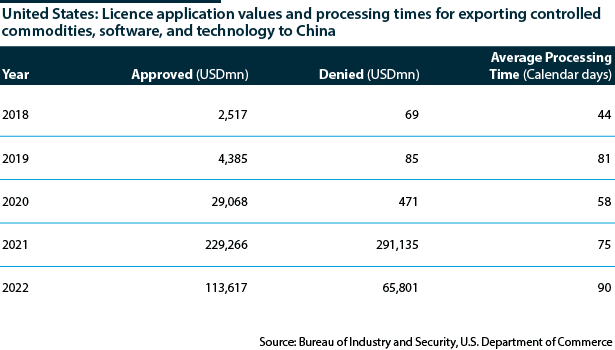

In addition, data from the US Bureau of Industry and Security shows that the export of controlled software and technology to China continued to surge after 2020. Although there have been prolonged processing delays, the approved amounts have been rising sharply.

It seems that the restrictions on exporting technology to China have encouraged more Chinese firms to apply for licences for acquiring controlled technology from Washington.

To protect its infrastructure from cyber threats, Washington recently proposed a ban on critical Chinese software and hardware in connected vehicles on US roads (see UNITED STATES/CHINA: Tech bans will intensify – September 25, 2024). As China continues to capitalise on its dominant position, the US government is likely to intensify efforts to extend export restrictions to third-party nations or impose bans beyond the transport sector, causing disruptions in global supply chains.