A much-touted exchange stabilisation agreement between Buenos Aires and Washington was announced on October 20

The Central Bank signed an exchange stabilisation (currency swap) agreement with the US Treasury on October 20, worth up to USD20bn. Peso stability following the September announcement of an imminent currency swap proved temporary, and the peso has continued to weaken despite direct US Treasury interventions in the domestic currency market. The terms of the deal have yet to be made public.

What’s next

Although the government insists that the currency band will be maintained after the October 26 midterms, the difficulties of accumulating reserves have fuelled expectations of exchange-rate policy changes. Washington and the IMF are encouraging the end of the currency band and adoption of a managed (or free) float, which would help to raise reserves. The US bailout may involve difficult conditions, such as limitations on China’s activities in Argentina.

Subsidiary Impacts

- For business, doubts over reform prospects and policy sustainability will delay or halt investment decisions.

- If the government does well in midterms, it may keep the currency band, curbing inflation but increasing stagnation and reserves woes.

- A US-Argentine trade agreement would undermine important domestic manufacturing industries such as pharmaceuticals and agrochemicals.

- Trump’s proposal to increase imports of Argentine beef to lower US prices would anger US farmers and drive higher food prices in Argentina.

- If Milei’s party wins less than 35% of the national vote it will be seen as a blow to his ability to sustain his policy agenda.

Analysis

It was expected that the terms of the bailout would be announced during the meeting between Presidents Javier Milei and Donald Trump at the White House on October 14. However, not only was there no announcement, but Trump warned that aid might be reconsidered if the government loses the October 26 midterm elections, alarming markets.

Continuing volatility

In the weeks before the midterms, Argentine financial markets have been volatile amid a series of announcements about a US bailout.

On September 22, US Treasury Scott Bessent published a message on X announcing that the US government would do ‘what was needed’ to support Argentina, with options including a currency swap, direct currency purchases and the purchase of US dollar-denominated Argentine public bonds using the US Exchange Stabilization Fund.

The same day Buenos Aires announced a temporary elimination of agricultural export taxes up to a total of USD7bn, to allow the Treasury to purchase the US dollars needed to defend the peso until the midterms. The USD7bn target was met in just three days, and export taxes reimposed, but the Treasury was able to purchase only USD2.2bn (see ARGENTINA: Economic stabilisation may be short-lived – October 1, 2025).

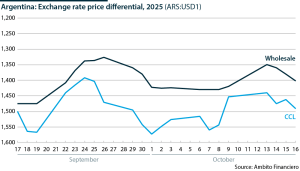

After the announcement of a US rescue package, the peso strengthened: the wholesale market exchange rate went from ARS1,475:USD1 (the ceiling of the currency band) to ARS1,326:USD1 on September 26. The price differential with the blue-chip swap dollar (CCL) also narrowed, from 6% to 4%, while the country risk premium fell from 1,456 to 898 basis points (bp).

However, in early October pressure on the peso re-emerged, taking the US dollar price differential to 10%, while country risk rebounded to 1,264 bp. This surge was driven by the reimposition of exchange controls on individuals and the fact that, by the first week of October, the Treasury had already sold 90% of the dollars purchased from agricultural exporters to shore up the peso.

On October 9, the US Treasury made a surprise first intervention in the domestic exchange market by directly purchasing pesos, which temporarily eased depreciation expectations. However, when on October 14 Trump stated that the US government would not “waste its time” aiding Argentina if Milei lost the elections, market uncertainty increased. Against this backdrop, new direct currency purchases by the US Treasury on October 15 and 16 were unable to prevent the peso weakening. By mid-October the official exchange rate was at ARS1,402:USD1, while country risk reached 1,004 bp.

Following the swap deal announcement on October 20 the rate reached ARS1,495:USD1, despite USD400mn in US Treasury purchases to date.

Stepping up measures

When Central Bank President Santiago Bausili announced on October 15 that Buenos Aires and Washington had reached a framework agreement on the currency swap, he gave no indication as to the terms. However, Bessent stated that the USD20bn swap line would be backed by US government assets in the Exchange Stabilization Fund, similar to a similar credit line extended to Mexico during the financial crisis of 1995, which carried substantial conditions.

Although it was initially suggested that the US lifeline would require termination of Argentina’s USD18bn currency swap with China, Bessent stated that US aid was in fact conditional on Argentina’s commitment to exclude China from its ports, space observation facilities and military bases. China has greatly expanded its investments in Argentina in the past decade, notably in mining, energy and infrastructure (see ARGENTINA: China will play increasing economic role – May 30, 2022; and see ARGENTINA: Railway sale may not bring hoped-for gains – November 28, 2024). Finding an alternative source of investment in those sectors would likely prove difficult.

Chinese trade and investment cannot be easily substituted

Bilateral trade deal

The deal with Washington would also in theory include a bilateral trade agreement, which is yet to be finalised. However, it is rumoured to involve the reduction of tariffs for certain goods (which could include industries such as food, energy, mining and software) (see ARGENTINA: Trade woes will increase stability risks – May 21, 2025).

Notably, on October 19, Trump suggested increasing Argentine beef imports to 70,000 tons at a 10% tariff rate in order to lower US beef prices — a plan that prompted pushback from the US farm sector. The deal could also involve some commitments on regulatory policies, especially concerning patent rights, which would mean a blow to the Argentine pharmaceutical and agrochemical industries.

Private-sector loan

On October 15, Bessent announced at a press conference that the US government was also working with banks and investment funds to create a USD20bn facility to invest in Argentina’s sovereign debt. Both Bausili and Bessent depict the current financial turmoil as a liquidity crisis, driven by the dollarisation of asset portfolios that usually occurs before elections.

However, the lack of details surrounding the new swap deal, as well as difficulties in arranging the facility with private banks, highlight that concerns go beyond pre-electoral liquidity shortages. A group of private US banks including Citigroup, Bank of America, Goldman Sachs and JPMorgan Chase are reportedly attempting to obtain assurances as to the availability of either Argentine collateral or US Treasury guarantees in order to agree the USD20bn loan package without becoming too exposed to Argentine debt.

The currency swap and new lending could increase Argentine debt without bringing stability

Solvency woes

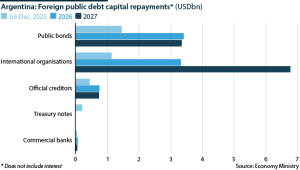

Solvency problems are also key, given the burdensome foreign debt-service schedule in the last two years of Milei’s government (USD34.2bn). Excluding debt repayments to international organisations (with which debt rollover is guaranteed), foreign debt repayments climb to USD2.3bn in the rest of 2025, USD12.8bn in 2026 (USD9.8bn of which is owed to private bondholders and banks) and USD19.0bn in 2027 (of which private creditors represent USD12.8bn). The government has failed either to accumulate reserves to repay foreign debt or to return to global capital markets this year.

The chances of a return to markets in 2026-27 will depend on Milei’s ability to recalibrate the economic programme and guarantee governability.

There are rumours that Washington may have conditioned its aid to Milei upon him opening dialogue with his political opponents after the midterms, which could strengthen governability and possibly pave the way to congressional approval of long-awaited structural reforms. His record thus far suggests that this is unlikely. Moreover, the perception that Trump has sought to interfere in the elections by threatening to withhold aid may work against Milei (see ARGENTINA: Milei will struggle to reset his government – September 11, 2025).