Higher tariffs and uncertainty over what will happen in July are weighing on consumer sentiment and retail planning

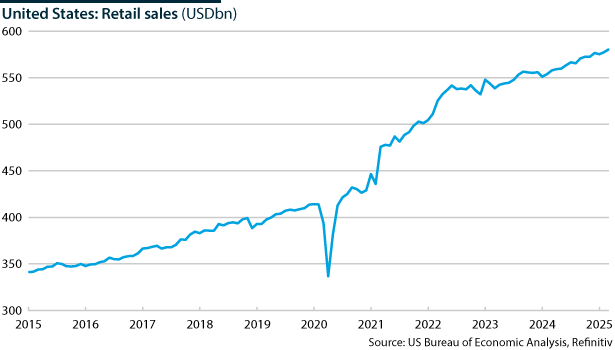

US retail sales are spiking as consumers buy cars and other goods to avoid expected tariff-induced price rises. Few retailers expect this spending to last, as already-fragile consumer sentiment weakens amid the uncertainties of President Donald Trump’s constantly changing tariff policy. It also makes it more challenging for the US Federal Reserve to gauge the underlying strength of consumer spending, which powers 70% of the US economy.

What’s next

Subsidiary Impacts

- Rampant uncertainty over tariffs and the retail outlook will complicate retailers’ inventory management and pricing.

- Legal challenges to tariffs by US retailers and trade groups will highlight the financial and legal burdens on businesses.

- Grey markets for imports and smuggling will increase.

- Advertising spending will likely fall as brands trim marketing budgets to cut costs to offset tariffs.

Analysis

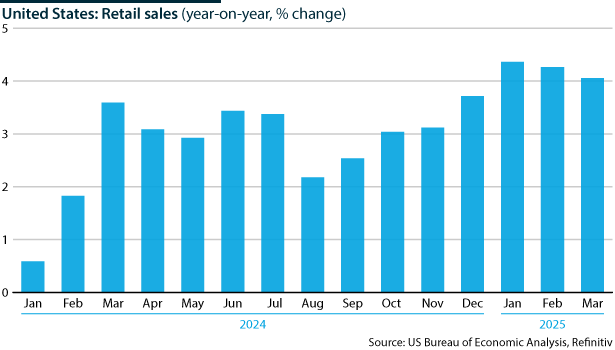

US retail sales grew by 4.1% year-on-year in the first quarter of 2025, almost double the 2.1% rate recorded one year earlier. Consumers frontloaded big-ticket purchases such as vehicles and furniture, expecting tariffs to raise prices. They also stockpiled imported necessities, such as toilet paper and coffee.

Meanwhile, retailers rushed to fill warehouses with stock before tariffs came into effect and diversified sourcing where possible. Responding to tariffs is more difficult due to the nature of the president’s tariff impositions as he switches back and forth on the order of policy goals that tariffs serve (see US: Tariffs will play a role far beyond trade issues – March 14, 2025).

Many US retailers are pausing or cancelling overseas orders. Unpredictable costs and supply chains are particularly destabilising as this is when retailers would typically place orders for the year-end holiday season.

The vast majority of goods and services US consumers buy are produced domestically. A Federal Reserve Bank of San Francisco study estimates that 11% of US consumer spending is traced to imported goods. However, the absolute numbers are large, so tariffs are disruptive for retailers, who, at an estimated USD940 billion, accounted for 28.5% of US imports in 2024.

28.5%

Retailers’ share of US imports in 2024

The impact on individual retailers will vary, depending on their supply chains and availability of alternative sourcing.

Consumer electronics

Companies selling consumer electronics, one of the largest categories of US imports, are among the retailers worst affected. Apple, for example, despite diversifying its overseas suppliers, still imports four-fifths of the iPhones it sells in the United States, its largest market, from China. It was looking at a potential doubling of its retail prices before the president included smartphones in the Harmonised Tariff Schedule codes that he announced on April 11 would be exempt from the 125% reciprocal tariff on Chinese imports.

Low-end apparel and household goods

Retailers and small businesses selling low-end clothing, toys and household goods source heavily from China. If they are less China-dependent than consumer electronics retailers, it is only because much of the manufacture of such products has left China for lower-cost countries in South and South-east Asia.

South and South-east Asian suppliers could be caught by Trump’s desire to stop China exporting via third countries

However, the ultimate ownership of many factories in those countries remains Chinese, one reason the president has imposed across-the-board tariffs. He will reportedly require countries not to be transhipment or offshore manufacturing hubs for Chinese enterprises as a condition of any US trade agreement to lower their reciprocal tariffs. This makes trade agreements a significant uncertainty for US retailers.

Few retailers will be able to absorb the tariff increases. They will pass them to consumers. The risk for retailers is that the higher reciprocal tariffs snap back in early July when their 90-day suspension ends and that even reduced tariffs on Chinese imports will remain high. That would put many ‘mom-and-pop’ stores, where pre-profit margins are typically 2-4%, and even department store chains with single-digit profit margins, under extreme financial stress.

E-commerce

The ending of the ‘de minimis’ exemption from May 2 for goods coming from China and Hong Kong will hit e-commerce hard. The exemption allowed a package sent to an individual containing goods valued at under USD800 to be imported tariff-free. The US customs agency says it processes 4 million de minimis packages daily.

Market researcher eMarketer estimates that the tariffs and postal fees that will be imposed on such packages could eliminate USD50 billion of sales by Chinese online retailers like Shein or Alibaba, which have taken advantage of the exemption, especially for cheap, fast fashion, but also by small retailers sourcing from China who sell on third-party marketplaces run by Amazon and US retailers such as Walmart and Target.

Large retailers

Large retailers have an advantage. They have tech capabilities and supply chain expertise that will enable them to mitigate the effects of tariffs. They also have scale leverage over their suppliers. Walmart, Target and Costco have pressed their Chinese suppliers to lower their prices, although Beijing has told Chinese suppliers not to cooperate.

Consumers tend to turn to lower-price retailers during uncertainty. Walmart told investors this month that it was reaffirming its full-year forecast of 4% sales growth, noting that in periods of consumer angst, it tends to increase its market share.

Food retailers

The United States imports 20% of the food it consumes. It exports roughly the same value, but the foods it imports are mostly those that, because of seasonality and climate, do not grow in the United States or not in quantities to meet demand, such as coffee (grown on only a few hectares in Hawaii), tomatoes and avocados (the two largest produce imports from Mexico).

Grocery stores are already raising prices, taking advantage of the recent acclimatisation of consumers to higher prices, and also to avoid making step changes in prices should reciprocal tariffs snap back in July.

Food stores are already raising prices to avoid a potential shock increase in July

Outlook

For many low-end imports sold by US retailers, there is no US-made alternative. Even if such goods could eventually be manufactured domestically, the cost would likely be too high to make it viable.

Supply chains will diversify, and domestic sourcing will increase. Yet the supply constraints are significant, especially near-term, as the Trump administration takes steps to prevent Chinese-origin goods being routed through third countries. Reconfiguring supply chains will require retailers to invest significant time, resources and expertise.

The financial risks of tariffs for retailers are growing (see INT: Tariff turmoil hits GDP and raises crisis risks – April 8, 2025). The US Treasury says it recorded at least USD15bn in tariff revenue in the month to mid-April (two-thirds of importers pay monthly on the 15th). That will largely be passed on to consumers, depressing sales by up to USD300bn this year, according to estimates. The tariff revenue announced in May will be far larger as it will include a month of the 10% baseline tariffs announced on April 2 and two weeks of ‘de minimis’ fees.