Taiwan’s semiconductor industry faces uncertainty abroad and structural constraints at home

Taiwan’s largest semiconductor producer, Taiwan Semiconductor Manufacturing Company (TSMC), saw its August sales increase 34% year-on-year, signalling robust global demand. Capitalising on the artificial intelligence (AI) boom, Taiwan aims to boost the value of its semiconductor chip output by TWD2.7tn (USD81.1bn) by 2028. The sector is crucial to Taiwan’s economy, but faces greater competition and uncertainty abroad plus a series of structural constraints at home.

What’s next

Due to its strong manufacturing capabilities and customer base, Taiwan is expected to remain the leading advanced chip producer over the next decade. However, Taiwanese producers of less advanced chips could face growing competition from Chinese firms subsidised by Beijing, while key firms like TMSC will face increasing interference and pressure as Washington seeks to reshape global supply chains. Domestically, both skills and potential energy shortages are likely to pose ongoing challenges to the industry’s long-term development.

Subsidiary Impacts

- US restriction on exporting semiconductor equipment to China will prevent Beijing’s chip makers from catching up with Taiwan.

- Domestic industries in chemicals, construction, machinery and financial services will benefit from Taiwan’s growing chip fabrication.

- Due to labour shortages, Taiwan will seek to utilise humanoid robots in its semiconductor manufacturing.

Analysis

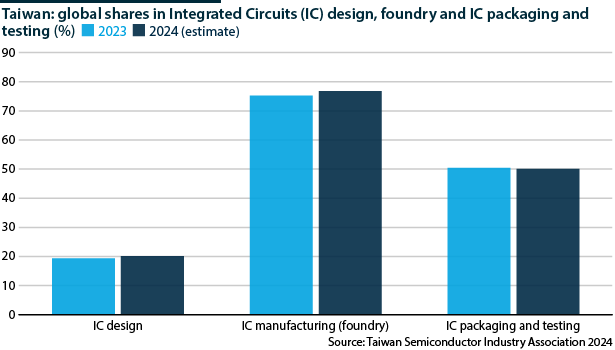

Companies in Taiwan hold a significant share in various stages of semiconductor chip fabrication. In 2023, Taiwan accounted for 20% of global integrated circuits (IC) design, 75% of the global foundry market share and 50% of IC packaging and testing.

The world’s reliance on Taiwan is especially pronounced in advanced chips. In 2022, Taiwan accounted for 69% of advanced chip fabrication — 10 nanometer (nm) and below — which is crucial for training and deploying advanced AI models. Although some advanced chip fabrication has been relocated to other countries in recent years, notably the United States, Taiwan is likely to remain a key advanced chip maker in the next decade, making 58% of the world’s advanced chips by 2030.

In 2022, Taiwan accounted for 69% of advanced chip fabrication

Taiwan’s manufacturing capabilities and skills are built on several decades of experience and continuous heavy investment in capital equipment and R&D. These present a formidable barrier for others to challenge its dominance.

Meanwhile, Taiwanese chip makers’ strong, long-term client relationships make it unlikely that its customers would switch their source of supply to a newcomer whose chip quality is uncertain.

Engine of growth

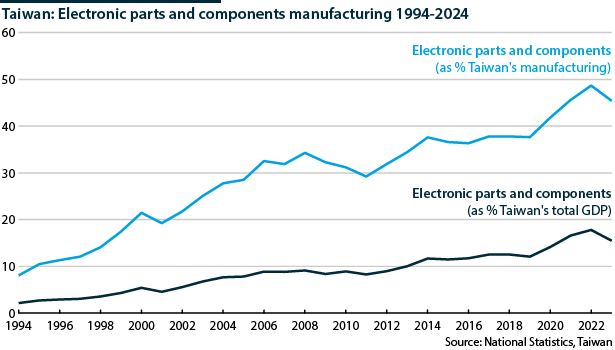

Taiwan’s semiconductor industry has been vital to the island’s economy. Official statistics indicate that electronic parts and components manufacturing production accounted for 16% of Taiwan’s GDP in 2023, up from 2% in 2003. It also contributed 45% of Taiwan’s total manufacturing production in 2023, up from 8% three decades ago.

In addition, semiconductor chips have been the primary source of Taiwan’s net export and capital expenditure, two key components in its economic growth formula. Importing expensive semiconductor equipment and tools — mostly from Europe, Japan and the United States — drives Taiwan’s capital expenditure. Large exports of semiconductor chips (mostly to China and other East Asian countries) offsets the import of expensive capital equipment, thus keeping net exports positive.

Taiwan therefore relies on its semiconductor industry for economic survival. However, a growing competitive and operational challenge is posed by foreign governments — including in Washington and Beijing — who have begun subsidising domestic chip manufacturing and seek to restructure the global semiconductor supply chain in line with national security and geopolitical objectives (see INT: Geopolitical tensions test Taiwan chips industry – August 9, 2024).

US President Donald Trump is pressuring TSMC to relocate some of its production to the United States. In early September, the United States also imposed restrictions on TSMC’s ability to ship US-made chipmaking equipment to its plants in China. Although it caused some operational disruptions, the impact of the latest restriction is likely to be limited since TSMC’s China chip plant accounts for only about 3% of its total chip fabrication worldwide.

Government policy

Given the semiconductor sector’s importance to Taiwan’s economy, the government has in recent years laid plans to sustain its development and competitiveness through several measures.

Tax incentives

In 2022, the government introduced a tax incentive for R&D-oriented companies in Taiwan. It also applies to companies that purchase advanced semiconductor equipment from abroad. Qualified companies can enjoy a business tax reduction of up to 25%.

Foreign Direct Investment

The government has also been encouraging foreign firms, especially companies that provide semiconductor materials, equipment and innovation, to invest in Taiwan. In May 2024, the Dutch firm ASML and US firms LAM Research and Applied Materials announced investment plans in Taiwan’s R&D. This is expected to generate USD440mn in local procurement and USD14.2bn in investment in the island. Micro and Nvidia are expected to receive USD150mn and USD22mn respectively in government subsidies, based on their current investment plans in DRAM and AI innovation.

Greater investment in the chip industry is expected to complete the domestic supply chain network. It will boost the use of local content in Taiwan’s chip exports and ensure smooth chip fabrication on the island in the event of any disruption to the global supply chain network: if more semiconductor tools and equipment can be produced in Taiwan, this will reduce the need to import essential equipment or materials from abroad.

Cultivating talent

The government plans to increase the number of students in semiconductor-related fields by 10,000 annually. Six semiconductor colleges were set up in six different universities in 2022. In addition, the government has been trying to recruit professionals to teach in semiconductor colleges or work in industry. However, language problems and relatively low wages remain hurdles to recruiting foreign talent.

Language and relatively low wages remain hurdles to recruiting foreign talent

Domestic constraints

Human capital played a crucial role in building Taiwan’s semiconductor industry in its early stages. However, a fast-ageing population threatens this advantage. In 2021, 27,000 engineering positions across the chip industry were left unfilled, a figure that surged to over 35,000 by early 2022, according to Global Taiwan.

Based on Taiwan’s official estimates, 20% of the country’s population will be aged 65 and above in 2025, with this figure expected to rise to over 30% by 2039. The working-age population is also projected to shrink from 16 million in 2024 to 13 million in 2040. Additionally, increasing investment in semiconductors abroad is likely to reduce the domestic workforce in the industry, exacerbating a ‘brain drain.’ Poaching of skilled workers by South Korean, Chinese and US firms that offer better pay and benefits has posed a continual challenge to the industry (see TAIWAN: Poaching semiconductor talent will persist – April 22, 2025).

In 2023, 620,000 Taiwanese people worked overseas. China, the United States and South-east Asian countries have been the main overseas destinations for Taiwanese workers. Notably, the number of people working in the United States has increased significantly, from 80,000 in 2013 to 128,000 in 2023. In contrast, the number of people working in China, Hong Kong and Macao declined from 430,000 to 217,000 during the same period, reflecting the shift in Taiwan’s outward foreign direct investment from China to the United States.

The greater use of robots in the manufacturing industries might alleviate the impact of an insufficient number of workers at home. However, Taiwan has not yet actively promoted their use. The island lags behind China, South Korea, Singapore and Germany in terms the number of robots per 10,000 workers (see CHINA: Humanoid robot industry will see a rapid rise – March 13, 2025).

Adding to skilled labour challenges is the potential energy supply shortage. TSMC currently consumes 8% of Taiwan’s electricity, a figure that could rise to more than 24% by 2030 as chip fabrication expands. Yet the depletion of nuclear power in Taiwan has raised concerns about a potential electricity insufficiency for its future chip fabrication needs. A referendum held on August 23 did not approve the reopening of Taiwan’s nuclear plant, leaving these concerns unresolved.