Since the Russian invasion of Ukraine, the EU’s boom in public and private defence investments has spurred military AI

Since 2022, several EU initiatives have been launched to increase defence spending in response to escalating geopolitical threats, including Russia’s invasion of Ukraine, rising cyberattacks and infrastructure sabotage. Together with cyber and electronic warfare, defence applications using military artificial intelligence (AI) and quantum computing are now among one of the seven priority areas where EU member states want to build up their capabilities.

What’s next

The EU will roll out several regulatory roadmaps in support of its defence and military AI aspirations. Funding for European defence R&D and innovative technology projects will also increase, particularly through the EU Defence Innovation Scheme, the Hub for European Defence Innovation and the European Innovation Council. Developing AI powered products, including military robots and associated software, will be a priority, but the bloc will struggle to catch up with the United States and China.

Subsidiary Impacts

- For business startups, scaling up will be a challenge unless progress is made on the Savings and Investments Union currently under review.

- Military industries and defence-related startups will need a clear and predictable purchasing calendar to fully ramp up capacities.

- Concentrating funding around defence tech may diminish focus on AI’s civilian applications.

Analysis

Until 2025, the scale of additional defence spending across EU countries remained limited. However, rising hybrid threats from Russia along with US President Donald Trump’s repeated warnings of disengagement from Europe have increased pressure on EU leaders to ramp up resources in defence.

ReArm Europe

Announced in March 2025, ReArm Europe/Readiness 2030 is the first ever coordinated programme aiming to boost defence spending in the EU by an estimated EUR800bn (USD932bn) by April 2029.

EUR800bn

Defence spending increase goal by April 2029

Most of the increase in defence spending will come from EU member states’ national budgets. Following the activation of the national escape clause to cover defence capabilities, defence expenditure can now be excluded from EU fiscal rules that limit government budget deficits. The clause was activated at the request of 16 member states and will cover a period of four years.

In 2024, EU defence spending increased by 19% to reach 1.9% of GDP. If all EU states use the full flexibility of the national escape clause, an additional EUR650bn in spending over the next four years promises to raise total EU defence budgets by 1.5% of GDP. This would also help member states move closer to the new 5% GDP total defence and security spending target agreed by the NATO in June for achievement by 2035.

SAFE

An additional EUR150bn will be provided by the new Security Action for Europe (SAFE) instrument. Through common EU debt issuance, SAFE provides low-interest-rate, long-maturity loans to finance the joint procurement of defence-related purchases by at least two member states. Loans will be repaid by borrowing member states to the EU.

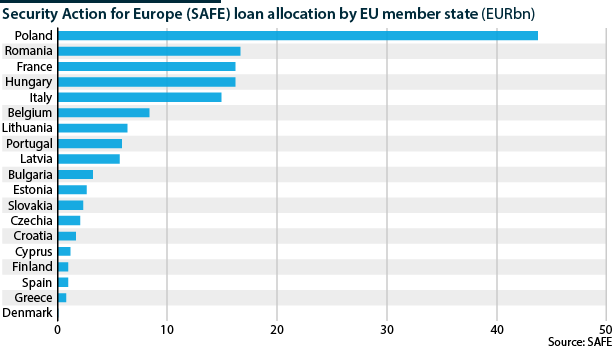

On September 9, the European Commission announced that the entirety of the EUR150bn had been allocated to 19 member states. Four are set to receive 71.2% of the financing, including Poland with the highest 29.2% share (see POLAND: Military AI development faces hurdles – August 4, 2025).

SAFE loans finance purchases sourced in the EU. Products need to contain a minimum of 65% European components — supporting the EU’s sovereign AI goals. As a general rule, contractors need to be established in the EU, Norway or Ukraine, and must not be under foreign control.

Products purchased under SAFE need to contain a minimum of 65% European components

Defence products are split into two categories. AI falls in the second category, subject to stricter eligibility conditions. Contractors must demonstrate the capacity to define, modify and adapt their product without being subject to non-EU restrictions (see INTERNATIONAL: AI raises the stakes in wars globally – July 30, 2024).

Flexibility

The European Investment Bank, the EU’s financing arm, has also increased defence financing significantly. In June, the EIB’s shareholders, the 27 EU member states, agreed to raise new financing to a record EUR100bn, with 3.5% allocated to security and defence.

EIB financing has a high multiplier effect. Funding provided through the European Investment Fund (EIF) — the EIB’s instrument for supporting European start-ups and scale-ups — mobilises private investment more than tenfold. The EIF’s Defence Equity Facility further encourages private investment in European companies developing innovative defence technologies with dual-use potential.

In June, the Commission acceded to a long-standing request from the industry and member states by cutting red-tape to accelerate defence preparedness. The so-called ‘defence readiness omnibus’ is a comprehensive package that streamlines administrative requirements and procedures for applicants, reduces time-to-grant and commits to predictable implementation.

Rising interest

Due to regulatory support and rising interest, since 2022, more than 230 defence tech startups have emerged in Europe, with venture capital investment reaching USD1.5bn in 2025.

Private investments are fostered by EU and national agencies. The European Defence Agency (EDA), the European Defence Fund and the partnership between the EIF and the NATO Innovation Fund have mobilised private investments and channelled financing into AI-powered analytics and certifiable military AI systems.

The EU’s two largest countries, Germany and France, have created agencies dedicated to the deployment of AI uses in defence, respectively the Cyber Innovation Hub of German Armed Forces (CIHBw), and the Ministerial Agency for Artificial Intelligence in Defence (AMIAD).

Most investments are dedicated to AI, surveillance, reconnaissance and advanced analytics (over 60%), with potential dual uses in civilian applications.

Defence AI ecosystem

As elsewhere, the largest European tech startups have received the majority of funding. In the EU, these include Germany’s heavyweight Helsing, founded in 2021 and specialised in AI applications for defence. In June, Helsing doubled its valuation to EUR12bn after raising EUR600mn. Helsing partners with France’s Mistral AI to develop AI defence systems. In September, Helsing and Germany’s ARX Robotics (Europe’s leading autonomous mobile robotics) announced a partnership to develop an AI-powered strike-reconnaissance system.

Many tech defence startups in other European countries deploy cutting-edge AI-powered solutions for the defence sector.

- Finland’s fast-growing Iceye deploys radar satellites to collect real-time images of Earth’s surface regardless of weather conditions. Iceye recently announced it was exploring raising new funding at a USD2.5bn valuation. In May, Iceye and the AI arm of Safran (France’s multinational aerospace and defence company) partnered to develop advanced multi-sensor AI solutions enabling faster and more accurate decisions in geospatial intelligence.

- Estonia’s Frankenburg Technologies, created only last year, has developed Mark 1, an AI-powered anti-drone missile, far less expensive and “a hundred times faster” to produce than existing anti-aircraft missiles.

- France’s Comand AI has developed Prevail, an AI-powered software suite dedicated to military command with automated feedbacks that speed up decision making on the battlefield.

- In May 2025, Latvia’s Origin Robotics unveiled AI-powered BLAZE, an autonomous drone designed to neutralise fast-moving aerial threats.

- Greece’s Sotiria Technology, created in 2021, designs AI-powered underwater intelligence and surveillance systems for critical defence and national security applications and infrastructure operators.

Lagging behind

Despite rising interest and regulatory support, the EU still lags behind the US and Chinese capabilities.

The United States dominates in defence AI thanks to deep integration between tech companies and the Department of Defense (see INT: Links between AI firms and militaries will grow – February 7, 2024). The Defense Innovation Unit launched in 2015 has boosted adoption of innovating technologies by the military and VC investments in tech startups.

In China, the government’s industrial policy allows for the scaling and acceleration of tech transfers from academia and industry to the defence sector, especially in autonomous systems, surveillance and cyber warfare (see CHINA: Military AI will advance, despite US controls – March 31, 2023).

According to McKinsey, European defence tech start-ups are about five years behind those of the United States, mostly due to larger venture capital markets. As in other sectors, EU defence tech startups therefore continue to struggle to scale up.