Despite positive first-quarter GDP growth, economic indicators are giving cause for concern

Argentina’s first-quarter current account deficit reached nearly USD5.2bn. Doubts are mounting over the government’s ability to sustain macroeconomic stability and growth in a less favourable environment. Negative sentiment has been fuelled by JP Morgan’s recent recommendation to reduce exposure to peso-denominated public bonds and by a New York court ruling ordering the government to hand over its 51% stake in oil company YPF to meet an earlier damages award.

What’s next

The threat to YPF, political uncertainty ahead of October mid-term elections and growing concerns over the current account deficit and the government’s ability to service foreign debt may raise pressure in the foreign exchange market, undermining economic recovery just months before the elections. The YPF case may raise investor reluctance to increase exposure to Argentina’s sovereign risk, delaying any return to global capital markets.

Subsidiary Impacts

- The disinflation process will be maintained at the expense of growth.

- Slower recovery and deteriorating labour indicators may undermine President Javier Milei’s support.

- While the government will focus on exchange rate stability before October, it may encourage a change in exchange policy post-election.

Analysis

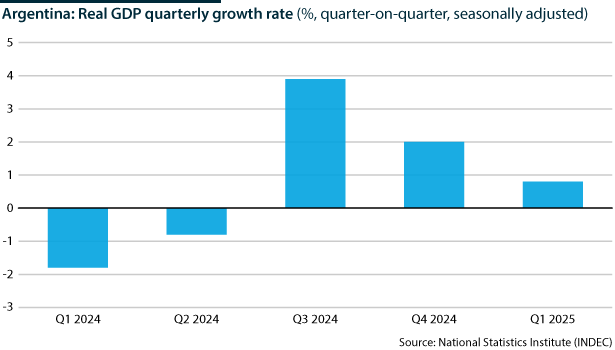

In the first quarter real GDP grew by 5.8% year-on-year, rebounding after the 5.0% fall in the year-earlier period. This was the second consecutive quarter in which real output expanded year-on-year, following the downturn that started in the second quarter of 2023. However, quarter-on-quarter the seasonally adjusted expansion was only 0.8%.

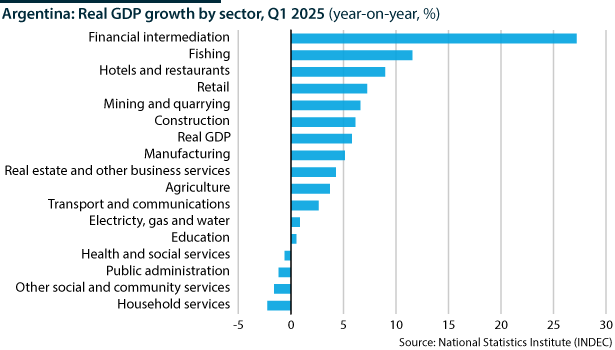

Unlike the last quarter of 2024, when year-on-year growth was led by exports of goods and real services, in the first quarter of 2025 the recovery was driven by fixed capital formation (up 31.8%) and private consumption (11.6%). Exports performed more modestly, with a rise of 7.2%. In a context of real currency appreciation and import liberalisation, goods and services imports rose by 42.8%.

Real currency appreciation fueled the import of consumer goods (up 64.8% by volume) and cars (69.3%), as well triggering a boom in foreign travel. However, consumption of basic goods was weaker: supermarket sales rose by only 2.9% year-on-year, and remained below the level reached in the same period of 2023.

Exchange rate and price stability, import liberalisation and economic recovery fueled fixed capital formation: the purchase of imported machinery, equipment and vehicles accounted for nearly two-thirds of its growth. Goods exports grew less strongly: though energy and fuels performed well, agricultural exports were undermined by a smaller soybean harvest, as well as lower export volumes of fishing products, vegetables, fruits and meat.

Private consumption reached a record for the first quarter (in a series beginning in 2004), exceeding the previous peak of 2018. This was unexpected, given that first-quarter unemployment rose to 7.9%, up from 7.7% in the year-earlier period and 6.4% in the fourth quarter, while private-sector wages fell in real terms, driven by the government’s rejection of above-inflation pay rises in wage negotiations.

Consumer credit

However, the main drivers of consumption were the steady rise in consumer credit and real currency appreciation.

Consumer credit has recovered rapidly from the floor reached in early 2024: by March 2025 it had accumulated a real rise of 117.5% since January 2024, while the private-sector credit to GDP ratio had increased from 4.4% to 7.9%. Credit growth stimulated the purchase of durable goods such as electronics, household appliances and vehicles.

Bank lending is slowing as NPL ratios increase

However, private consumption growth may have lost momentum in the second quarter, as bank credit to the private sector slowed. This coincided with the deterioration of private-sector non-performing loan (NPL) ratios: households’ NPLs increased from 2.6% in December 2024 to 3.7% just four months later. Though the ratio for companies was lower (0.9%, up from 0.7% in December), there was a rise in returned cheques, reportedly not seen since the crisis driven by the COVID-19 pandemic. The rise in interest rates on some commercial and personal loans during the second quarter may worsen these ratios.

Economic growth was more volatile in the second quarter. In April statistics institute INDEC’s Monthly Estimate of Economic Activity (EMAE) rose by 1.9% month-on-month, accumulating a rise of 6.3% in the first four months of 2025. However, the General Activity Index, estimated by private consultancy Orlando Ferreres, contracted by 0.2% in May, raising new doubts about recovery amid slowing bank credit, stagnating real wages and the impact of real currency appreciation on domestic production and unemployment.

Debt concerns

Investors’ concerns are not only focused on Argentina’s ability to sustain economic growth, but also to repay foreign debt:

- By the end of March gross central government debt reached USD473.6bn, up 17.5% year-on-year.

- Medium- and long-term debt amounted to USD407.9bn, with public bonds accounting for 78.5% and loans owed to international financial institutions for another 18.6% (10.1% to the IMF).

- Foreign-currency debt reached USD255.3bn, equivalent to 53.9% of the total, although external debt accounted for only 28% of the total.

Both foreign-currency debt and external debt ratios have fallen compared with 2017, before the financial crisis that led to a currency devaluation and an onerous IMF deal under President Mauricio Macri. This indicates that since the 2018 crisis non-resident investors have been reluctant to increase their exposure to Argentina’s sovereign risk significantly.

1,012.8%

Ratio of foreign-currency debt to international reserves

At the same time, the ratio of foreign-currency debt to international reserves has worsened, from 395.6% in 2017 to 1,012.8% in 2025. This is a key investor concern, given the Central Bank’s failure to accumulate reserves, worsening external accounts and the burdensome debt-service schedule for the next two years (see ARGENTINA: Trade woes will increase stability risks – May 21, 2025).

Foreign-currency debt service amounts to USD8.8bn in the second half of 2025, and to USD19.7bn in 2026. In July 2025 debt amortisations reach USD4.9bn, which the government claims to have acquired through a new REPO loan and the issuance of peso-denominated bonds that can be subscribed with dollars. However, the government needs to regain access to global capital markets to remove doubts about 2026 debt repayments; as of end-June the country-risk premium remained well above the level required for this to happen.

Investor gloom

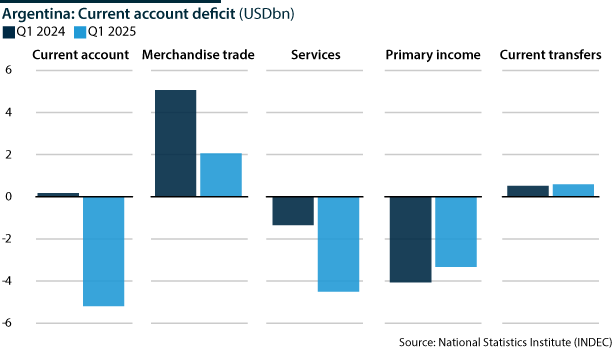

The deterioration of the balance of payments is also raising investor concerns (see ARGENTINA: IMF deal may not halt economic volatility – April 1, 2025) In the first quarter the current account posted a deficit of USD5.2bn, following a small surplus last year. This was driven by the fall in the merchandise trade surplus and the sharp rise in the services deficit (to USD4.5bn, from USD1.3bn in the year-earlier period), largely due to the boom in foreign travel: the deficit of the travel account rose from USD709mn in the first quarter of 2024 to USD3.5bn in the first three months of 2025.

Other recent developments are also undermining investor sentiment:

- On June 30 a New York district court ordered Argentina to relinquish its 51% stake in renationalised oil company YPF, in partial payment of a USD16bn judgement in favour of minority shareholders prejudiced by the terms of the 2012 expropriation.

- Following a mid-June mission to review progress on the April Extended Fund Facility agreement, the IMF has yet to issue any public statement and has not released the USD2bn tranche the government had been expecting (see ARGENTINA: Long-term debt risks persist after IMF deal – April 22, 2025).

A recent report by JPMorgan again highlighted the risks involved in investing in Argentine debt, notably the high balance of payments deficit, the overvalued exchange rate and uncertainty surrounding the October legislative elections. Although polls still suggest that Milei’s party will increase its minimal representation in the new Congress, mounting divisions among the president and allies, greater unity among the Peronist opposition and rising pressures from provincial governors suggest that governability may be fragile (see ARGENTINA: Political and economic frictions will rise – June 10, 2025).