Saudi Arabia faces an uncertain oil outlook, undercutting financing needed to move with economic diversification plans

Saudi Arabia is targeting inward foreign direct investment (FDI) to diversify its economy as demand for oil peaks, but FDI last year failed to accelerate as planned The price of Brent crude has fallen from around USD75 per barrel to just over USD60 per barrel in the aftermath of US global tariff moves. The impact on fiscal revenue has prompted the government and Public Investment Fund (PIF, the country’s sovereign wealth fund) to tap debt markets heavily.

What’s next

Subsidiary Impacts

- Lower dividends from Saudi Aramco will weigh further on government and PIF spending.

- Riyadh and Washington could sign a civil nuclear cooperation agreement later this year.

- Saudi investments in renewable energy will rise.

Analysis

The government forecasts that it will run a deficit of about USD27bn this year, roughly 2.3% of GDP. The IMF had previously pegged Saudi Arabia’s budgetary breakeven oil price (at which it would run neither a budget deficit nor surplus) at USD96.2 per barrel in 2024 and USD84.7 per barrel in 2025. The inclusion of spending by PIF adds about USD17 per barrel to the breakeven price (see SAUDI ARABIA: Oil policy faces uncertain outlook – November 25, 2024).

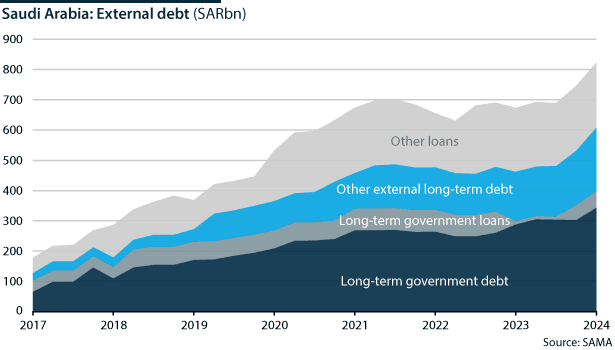

According to the kingdom’s National Debt Management Centre, the government’s funding needs this year are about SAR139bn (USD37bn). A little over SAR100bn will cover the budget deficit, and the rest would be allocated to repaying maturing debt (see SAUDI ARABIA: Ratings upgrade will buoy debt issuance – March 17, 2025 and see SAUDI ARABIA: Fiscal deficit may widen in 2025 – March 4, 2025).

In 2024, Saudi Arabia had already advanced above China as the most active issuer of international debt in emerging markets. This trend will continue in 2025. The government opened the year by raising USD12bn from global debt markets in a three-part bond sale in January. PIF also issued a USD7bn loan from three banks using Islamic financing, or Sukuk. Meanwhile, the finance ministry said separately in January that it finalised another Shariah-compliant loan (Islamic law) worth USD2.5bn from three unnamed regional and foreign banks.

Debt is helping to plug short-term financing needs

PIF is driving the construction of the NEOM mega-city on the Red Sea coast, which includes the 170-kilometre-long city, The Line. Saudi Arabia has had to curb its ambitions for this hallmark project, reflecting financing challenges. Instead of 1.5 million people living in The Line by 2030, Saudi officials now anticipate fewer than 300,000 residents. The Line will also now run for about only 2.4 kilometres by 2030.

The fund is additionally investing in housing, tech startups, mining and manufacturing. It is leading infrastructure investments needed to host the 2027 AFC Asian Cup, the 2029 Asian Winter Games, the 2030 WorldExpo and the 2034 FIFA World Cup.

Foreign investments push

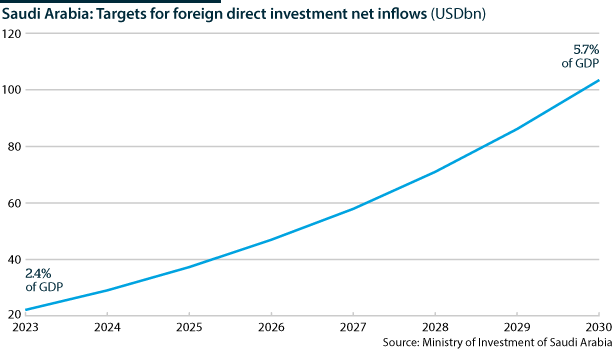

Saudi Arabia wants foreign investors to buy into its economic transformation plan, but is still falling short of its targets. The government aims to attract USD100bn in FDI by 2030.

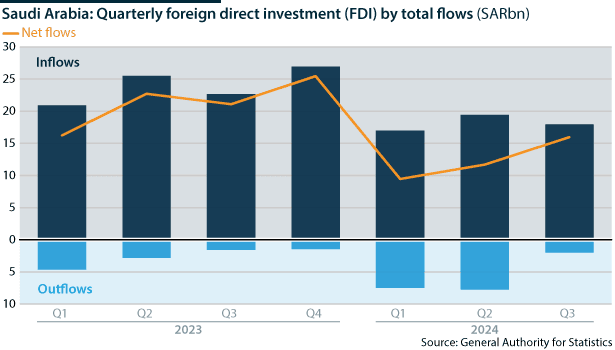

In 2023 the kingdom received USD25.6bn in FDI, or just 2.4% of nominal GDP. Recent data suggest that FDI is struggling to accelerate. FDI into Saudi Arabia declined 24% year-on-year in the third quarter of 2024. FDI has barely nudged up from 2022, when it stood at USD4.4bn in the third quarter.

This is probably because the country still faces stiff regional and international competition for FDI, and it continues to find difficulty in building its attractiveness as an investment destination.

FDI flow are still not gaining major traction

Minister of Investment Khalid al-Falih attempted last year to address the matter. For instance, he referred to NEOM as a “generational investment”, saying that foreign investment will increase. He suggested that while foreign investors were previously questioning the project, confidence in it is now growing, and that the “risk-return trade-offs are very, very fair and positive” (see SAUDI ARABIA: Authorities bank on more investments – November 26, 2024).

The government is additionally betting that recent regulatory and administrative reforms will help encourage FDI. It updated the country’s investment law last year, and the legislation went into effect this year. The law introduces protections for foreign investors, including through enforcing equal procedural treatment. Reforms also aim at facilitating the transfer of funds and simplifying registration processes. The law had followed other changes to the judicial system, such as a new civil code and the introduction of an administrative enforcement court.

Retail investors interested

Previously, retail investors in the West struggled to tap into Saudi Arabia’s bond market because of bureaucratic hurdles and a high barrier to entry, relative to institutional investors.

In December 2024, State Street Global Advisors launched an exchange traded fund (ETF) that allows investors to access Saudi Arabian government bonds. The Fund, SPDR JPMorgan Saudi Arabia Aggregate Bond Ucits ETF, invests in liquid, US dollar- and Saudi riyal-denominated government debt. Months before, Franklin Templeton had introduced an active Saudi Bond ETF.

For Saudi Arabia, exposure to Western retail investors is high on the list of priorities. While State Street and Franklin Templeton are private investment managers, their moves present an opportunity to create more outlets for demand.

Debt outlook

Saudi Arabia has the space to take on more debt. Its debt to nominal GDP reached 29.9% in December 2024, a low figure compared with most countries. Nonetheless, the issue is with the pace of the Saudi debt-issuance drive. Debt to GDP has almost doubled in a decade.

Saudi Arabia will rely more heavily on debt as oil prices lag. It will need that debt to finance investments to make its economy less reliant on oil revenue. Yet for the near future, the state budget will remain highly dependent on oil. In 2026, the IMF says that oil revenue will make up about 26% of GDP. The last time Saudi Arabia ran a budget surplus was 2022, after Russia’s invasion of Ukraine led to a surge in oil prices above USD100 per barrel.