An EY report prepared in collaboration with Oxford Analytica.

An EY report prepared in collaboration with Oxford Analytica.

Smart sensors are the drivers of Industry 4.0 and the Internet of Things (IoT) in factories and workplaces. Once implemented at scale, the combination of sophisticated sensors and increased computational power will enable new ways to analyze data and gain actionable insights to improve many areas of operations. The result will be responsive and agile production processes that ensure and enhance performance across a range of industrial sectors.

The impact of sensors on company performance, both today and in the coming years, will be primarily through cost savings. We analyze four ways in which companies stand to attain cost savings through implementing sensor technologies:

- Increasing production flexibility and worker responsiveness.

- Reducing equipment downtime through predictive maintenance.

- Improving quality control and reducing waste.

- Improving understanding of cost structures.

Early adoption of smart sensor technology has been concentrated on improving the manufacturing process of existing products. But the ultimate revolution associated with Industry 4.0 lies not simply in cost savings through optimizing the production process, but with new business models, services and individualized products. Such new products are likely to be developed first through customization and subsequently through the conjunction of smart sensor data and data analytics to enable companies to offer a combination of high precision, high reliability, and high volume. In addition, data collected by sensors will help to create new services linked to the use of particular products.

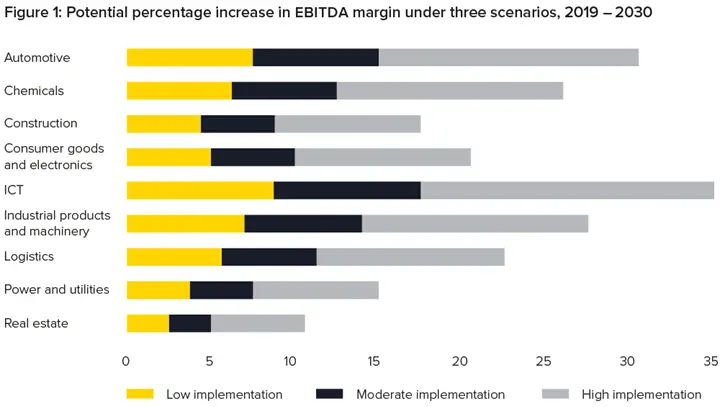

Our quantification of the impact of sensors over the period to 2030 compares nine sectors: Industrial products and machinery, consumer goods and electronics, ICT, automotive, construction, real estate, chemicals, logistics, and power and utilities. Under the best-case ‘high implementation’ scenario, the EBITDA margin could increase by 11%–34%, depending on the sector. While it will be unlikely for such an ambitious level of adoption to be attained by 2030, even under a more moderate rate of adoption the likely EBITDA impact could be substantial.

Automotive and ICT are the two sectors that are likely to see the biggest impact in terms of boost to EBITDA, followed by industrial products and machinery. Both automotive and ICT have margins of 12%–13% at present, and both sectors could see 2030 operating margins of 15%–17% under a ‘high implementation’ scenario. In these and other sectors, the challenge facing corporate leadership teams in the coming years will be how to transform their companies to make such increases in profitability possible.

Learn More

The Client

EY is committed to building a better working world – with increased trust and confidence in business, sustainable growth, development of talent in all its forms, and greater collaboration.