Summary

Challenge: to undertake a literature review to reflect the growing recognition that company valuation methodologies must be recalibrated to include non-financial factors.

Challenge: to undertake a literature review to reflect the growing recognition that company valuation methodologies must be recalibrated to include non-financial factors.

Outcome: the literature review charts both traditional valuation methodologies as well as emerging frameworks, and relevant developments in business, finance and public policy will be monitored.

Description

The Caux Roundtable retained the OA Foundation to design a project that would reinforce the linkages between sustainable development values and responsible business conduct. This was especially timely given the promulgation of the UN Sustainable Development Goals (SDGs) and the call for private sector engagement.

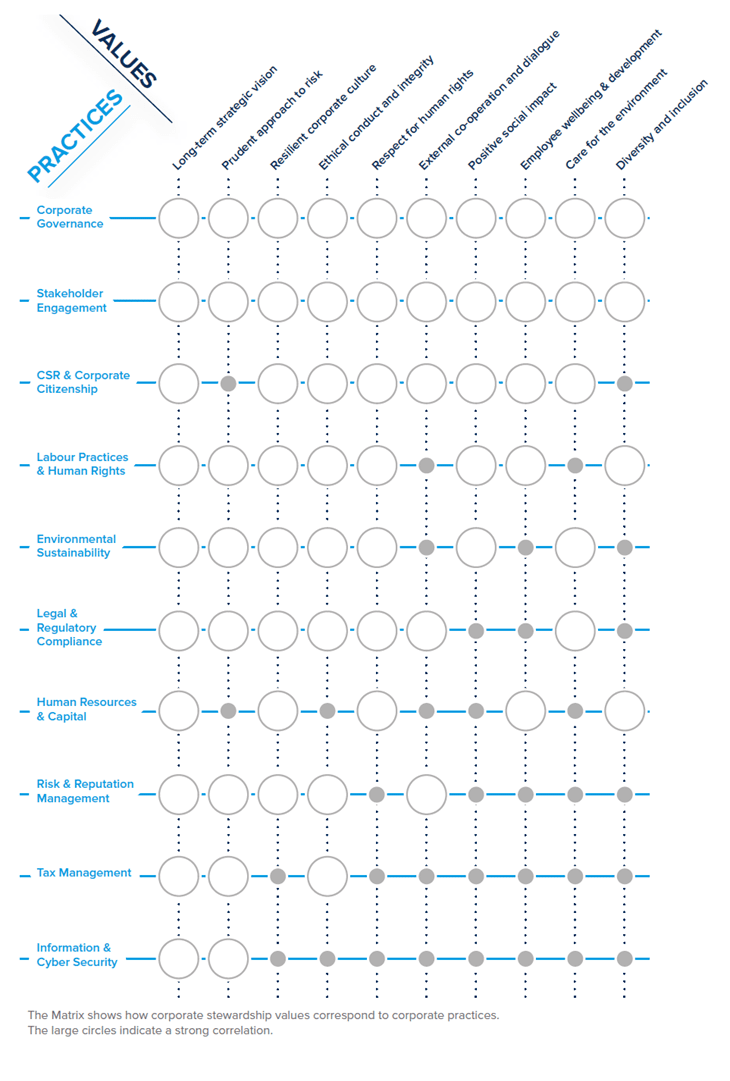

The Corporate Stewardship Compass, launched in 2017, confirmed that building a culture of stewardship requires the alignment of values with business practices. With analysis grounded in the Dow Jones Sustainability Index (DJSI), the Corporate Stewardship Compass offers leadership guidance based on the performance of some of the world’s most sustainable companies.

”The price of a firm, its value expressed in money, reflects many factors, both tangible and intangible.

Within the Corporate Stewardship Compass, questions of measurement featured in several ways – including the complex relationship between the advancement of social and environmental values and the calculation of company value. The consultation process indicated that the development of an inclusive and practical model to address such questions could mark a turning point for systemic change. Indeed, several experts deemed this to be the “Holy Grail” of our age of sustainability. Such observations resonated with the CRT’s longstanding quest for fresh understandings of capital and intangible assets, along with their potential contribution to both business and societal success. Thus, the CRT and the OA Foundation turned their attention to preparing a concise survey within the evolving field of company valuation.

The resulting literature review charts both traditional valuation methodologies as well as emerging frameworks. It also highlights the significant thought leadership within various multi-sector initiatives. The relevance of the project is underscored by the growing momentum for new approaches to company valuation.

Report structure

Towards a New Paradigm of Company Valuation: A Literature Review of Emerging Frameworks for Long-term Social and Environmental Sustainability is comprised of two main sections, followed by concluding observations.

Part One: Review of Academic Literature on the Changing Scope of Company Valuation Methodologies

This section offers a brief annotated bibliography, divided into two categories. The first presents leading books and articles about traditional valuation methodologies from both an academic and practitioner’s perspective, addressing private and public companies. The second presents leading books and articles on emerging metrics for valuation, focusing on social capital, human capital, natural capital, and reputational capital.

Part Two: Review of Thought Leadership on Sustainable Value Creation and Measurement

This section features descriptions and web-links for high-level collaborations such as the Embankment Project for Inclusive Capitalism, the Sustainable Stock Exchanges initiative, the Social and Human Capital Coalition, and the British Academy’s Future of the Corporation Program. Such a collection of resources, drawing on expertise from various sectors, serves as a useful complement to the academic-style literature review. Moreover, it offers insights on potential reforms in business practices and public policies.

Next steps

Read the Caux Round Table literature review